In today’s highly regulated corporate environment, ROC compliance is not optional — it is essential. Every company registered in India is legally required to comply with the provisions of the Companies Act, 2013, by filing periodic returns and disclosures with the Registrar of Companies (ROC).

Timely ROC compliance ensures:

ROC (Registrar of Companies) compliance refers to the statutory obligations every company registered in India must fulfil under the Companies Act, 2013. These include periodic filings, event-based disclosures, and statutory requirements to remain legally compliant, avoid penalties and maintain good corporate governance.

Mandatory Filings Every Year

Compliance Item | ROC Form | Due Date |

Annual Return | MGT-7 | Within 60 days of AGM |

Financial Statements Filing | AOC-4 | Within 30 days of AGM |

Director KYC | DIR-3 KYC | 30th September every year |

Auditor Appointment (if applicable) | ADT-1 | Within 15 days from AGM |

In addition to annual filings, companies must inform ROC any time specific corporate events occur:

Event | ROC Form | Typical Due Date |

Change of Directors | DIR-12 | Within 30 days of change |

Change of Registered Office | INC-22 | Within 30 days |

Increase in Authorized Capital | SH-7 | Within 30 days |

Resolution Filing | MGT-14 | Within 30 days of Board approval |

Statutory Registers & Records | — | Ongoing update requirement |

Phase 1: Preparation (Before Filing)

Phase 2: E-Filing on MCA Portal

Phase 3: Post-Filing Compliance

Record Maintenance: Maintain both digital and physical copies of all filed forms, challans, and acknowledgments for future reference and regulatory checks.

ENTITY TYPE | FINALISATION OF ACCOUNTS & AUDIT | BOARD MEETING APPROVAL | AGM | DOCUMENT COMPILATION & FILLIMNG FORMS |

Private Limited Company | Applicable | Applicable | Applicable | AOC-4, MGT-7 / MGT-7A, ADT-1, and others. |

Public Limited Company | Applicable | Applicable | Applicable | AOC-4, MGT-7, ADT-1, and others. |

Section 8 Company | Applicable | Applicable | Applicable | AOC-4, MGT-7, and others. |

One Person Company (OPC) | Applicable | Limited / Resolution by Sole Member | Not Applicable | AOC-4, MGT-7A, ADT-1 (if applicable), and others. |

Limited Liability Partnership (LLP) | Applicable (audit if threshold crossed) | Not Applicable | Not Applicable | Form 8, Form 11, LLP and others. |

Failure to adhere to the filing obligations prescribed by the Registrar of Companies (ROC) in India may lead to severe legal consequences, including hefty daily penalties, disqualification of directors, operational restrictions, and risk of company strike-off.

Your Compliance, Our Responsibility

ROC compliance is the backbone of a legally sound and well-governed company. Missing even a single filing can lead to heavy penalties, director disqualification, and loss of corporate credibility. With changing regulations and strict enforcement under the Companies Act, 2013, staying compliant requires accuracy, consistency, and timely action.

Our ROC Compliance services are designed to take the compliance burden off your shoulders—ensuring that your company meets every statutory requirement without delays or errors. Whether you are a startup, a growing private company, or an established corporate entity, we help you stay compliant, transparent, and future-ready.

Focus on growing your business. We’ll take care of the compliance.

Yes. Every company registered under the Companies Act, 2013 is required to comply with ROC filing obligations, irrespective of its size or turnover.

Failure to file ROC returns may lead to daily late fees, penalties on the company and its directors, and in serious cases, disqualification of directors or striking off of the company.

Yes. Even if a company has not carried out any business during the year, ROC compliances must still be completed unless the company is officially declared dormant.

Every company is required to conduct its AGM by 30th September, which is within six months after the financial year ends on 31st March.

MSME Form 1 is filed twice yearly:

This applies when payments are delayed beyond 45 days.

Private Limited Companies, Public Limited Companies, and Limited Liability Partnerships (LLPs) are required to be registered with the ROC.

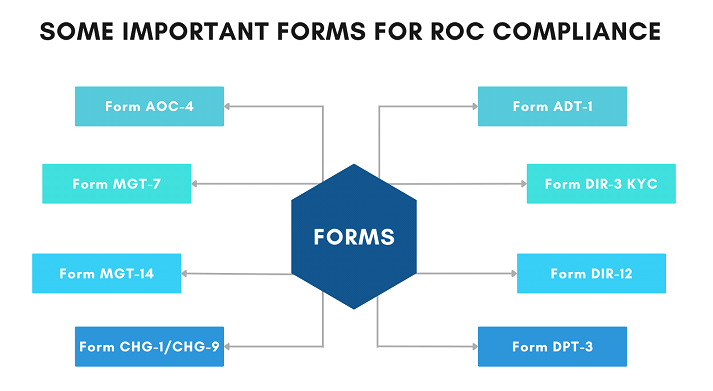

The main annual ROC forms include:

The responsibility lies with both the company and its directors. Non-compliance can attract penalties on the company as well as personal liability on directors.

DIR-3 KYC must be filed by 30th September every year for all directors holding an active DIN.

Timely ROC compliance ensures legal continuity, protects directors from disqualification, and helps maintain the company’s credibility with banks, investors, and regulators.